Si prefieres ver la web siempre en español, haz click aquí.

La Junta General de Accionistas 2024 tendrá lugar el miércoles 24 de abril a las 12:00 h (CEST).

Si prefieres ver la web siempre en español, haz click aquí.

Descubre en un minuto el producto que más se adapta a ti.

Descubre en un minuto el producto que más se adapta a ti.

{{content.phone.text}}

{{content.phone.phoneText}}

{{content.form.text}}

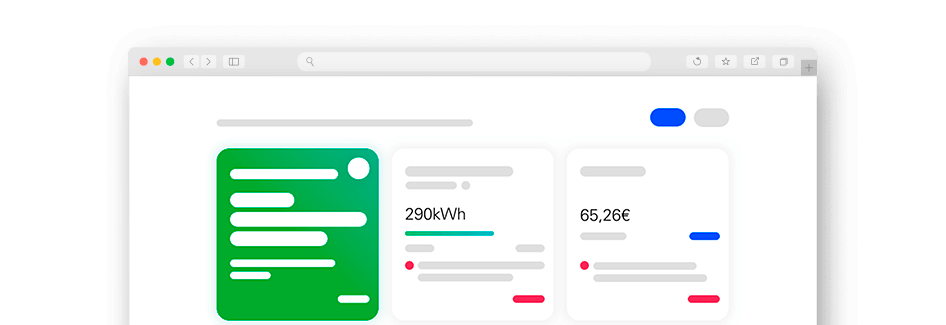

En Endesa no tienes que adaptarte a nuestras tarifas porque ellas se adaptan a ti. Compara tú mismo las diferentes tarifas entrando en nuestro catálogo. O si lo prefieres responde a unas pocas preguntas y nosotros nos ocupamos de comparar entre todas las tarifas de luz y gas para ofrecerte una recomendación personalizada.

Descubre en un minuto el producto que más se adapta a ti.

{{content.phone.text}}

{{content.phone.phoneText}}

{{content.form.text}}

En Endesa no tienes que adaptarte a nuestras tarifas porque ellas se adaptan a ti. Compara tú mismo las diferentes tarifas entrando en nuestro catálogo. O si lo prefieres responde a unas pocas preguntas y nosotros nos ocupamos de comparar entre todas las tarifas de luz y gas para ofrecerte una recomendación personalizada.

Una vez registrado podrás controlar toda tu energía desde cualquier lugar. Sabrás cuánta electricidad gastas en cada momento de cada día.

Sustituimos tecnologías del carbón por renovables y promovemos la electrificación

Sustituimos tecnologías del carbón por renovables y promovemos la electrificación

Sustituimos tecnologías del carbón por renovables y promovemos la electrificación

Contribuimos a la evolución de la red eléctrica para mejorar la calidad del servicio

Contribuimos a la evolución de la red eléctrica para mejorar la calidad del servicio

Contribuimos a la evolución de la red eléctrica para mejorar la calidad del servicio

Desplegamos infraestructuras de recarga para democratizar la movilidad sin emisiones

Desplegamos infraestructuras de recarga para democratizar la movilidad sin emisiones

Desplegamos infraestructuras de recarga para democratizar la movilidad sin emisiones

Impulsamos iniciativas digitales para mejorar la eficiencia y reducir el coste del servicio

Impulsamos iniciativas digitales para mejorar la eficiencia y reducir el coste del servicio

Impulsamos iniciativas digitales para mejorar la eficiencia y reducir el coste del servicio